If central banks really do what it takes to address the inflation crisis then the left tail for equities and the right tail for rates are both opened up significantly, and in a way that we have not experienced for several decades.

The global inflation crisis has worsened and reaccelerated. Global May CPI (ex. Turkey) is tracking a 0.7% m/m gain, the second-highest monthly increase on record, and, per JP Morgan, global CPI will rise at ~10% yoy this quarter.

Last week's developments in data and markets have laid bare the growing crisis now faced by the ECB and the Fed. There is a real risk that the current policy making tool kit and parameters are fundamentally unsuited to the inflation challenges they are now facing

In the US, the Fed faces trade-offs not seen since the 1970s and 80s.In Europe, the trade-off between an inflation shock in a context of heterogeneous sovereign credit risks is unprecedented in the life of the Eurozone.

These trade-offs have been reflected in the global asset market price action through extreme moves wider in European sovereign spreads and a sharp sell off in European equities and a acute, correlated selloff in fixed income and equities in the US. Indeed in the US, the only other instance in the last 40 years where over a 2 day period, 2y rates moved higher by more than 50bps and equities lower by more than 5% was October 14 1987 which preceded the Black Monday crash of October 17 1987.

So what happened?

1. Europe: At a headline level, last week’s ECB meeting was a significant hawkish pivot, delivered primarily through its statement and staff projections, which saw significant increases to near-term inflation forecasts and downgrades to growth. Implicit in these staff projections is that policy is likely to be restrictive on a go forward basis. The intent was to open up a more front loaded hiking cycle, including the strong possibility of a 50bp increase in September.

However, this hawkish pivot was not given a substantive explanation by ECB President Lagarde. Furthermore, Lagarde offered no specifics as to which tools they would or could use to prevent “fragmentation” or sovereign spread widening in a case of an aggressive hiking cycle.

This lack of certainty about what the policy stance compounded the effect of the hawkish statement and forecasts. Risk premium in European front end rates increased, and no guidance on anti-fragmentation tools saw spreads widening sharply. For spreads, the ECB has no consensus as to what their plan would be in the case of a major increase in sovereign spreads, at the same time as inflation requires an aggressive hiking cycle. At worst, there is no more ECB backstop outside of a major crisis.

2. US Inflation: The US inflation print was shocking to the market, politicians, ex policy makers and, implicitly based on recent statements, the Fed.

The headline CPI index rose by 1.0% in May, raising the yoy rate to 8.6% (its highest since 1981). The core index increased 0.6% last month, with broad based increases in the stickiest part of the inflation basket, alongside shelter increasing to a cycle high of 0.6%, with rents showing the highest reading in several decades.

There was no silver lining in this reading. Energy and food prices are set to stay elevated or worsen, the sharp fall in housing affordability and lack of supply will continue to pressure rents higher, the labor market remains tight. Heading into the second half of this year, US inflation has broadened and accelerated, and this is being reflected in long-term inflation expectations, with the Univeristy of Michigan median five-year-ahead measure rising from 3.0% to 3.3%.

Implications - A much wider left tail

The bottom line is that the hawkish shifts by policymakers have, so far, been woefully inadequate to address the scale of the inflation shock. In chronological order, the problem was ignored, misdiagnosed, under estimated, and is now being managed conservatively. For example, the last inflation print in Europe was 8.2%, wages are increasing sharply, their own staff forecasts show a sharp increase in inflation, and the ECB’s own policy guidance is to continue to have negative interest rates heading into September!

The Fed has made a similar mistake, pre-committing to 2 x 50bp hikes, and some governors even discussing a potential pause while the data would subsequently show inflation was in fact accelerating.

It is clear that current policy is inappropriate for the inflation challenges currently being faced.

Recent data does not support the scenario of a gradual easing of inflation pressures (a soft landing) through easing supply chain bottlenecks and the impact of broadly tighter financial conditions. Much like we saw with Poland, waiting for a deus ex machina solution to inflation only exacerbates the ultimate policy tightening necessary.

What data does support is that we have passed the point where inflation can be addressed in the US and Europe without a major demand contraction. If that point has been passed, the longer policy makers wait, the worse the problem becomes, and the more painful the re-adjustment.

In the case of Europe, the implications for sovereign spreads add to this tail, and we have not tested whether a monetary union without fiscal union can survive a true inflation shock. The trade offs are clearly grim.

Fannie Mae 30y Mortgage Rates – 6.13.22 is the 4th largest single day increase in 20 years

Therefore, the central question shifts to whether policy makers will actually follow through on the monetary policy required to address inflation. This means an exit from any semblance of gradualism and a toolkit much closer to an orthodox EM central bank.

This would be a category shift for the market. Looking at the the equity sell-off in May, interest rates fell and resultantly financial conditions eased. This is precisely the opposite of what is needed. If central banks really do what it takes then the left tail for equities and the right tail for rates are both opened up significantly and in a way that we have not experienced for several decades.

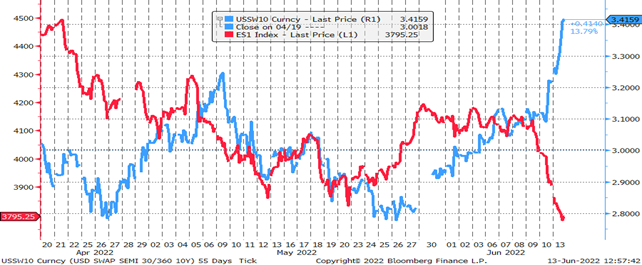

10y US Swap rates: Blue / S&P 500: Red – In May equities and rates moved together providing a shock absorber for long duration assets. This is not the case in June.

This week, the Fed will be instructive, with full updates of dot plots and projections. There is now a 50% probability of a 75bp hike in July, but this seems light in the context of the inflation outlook. To quote Jason Furman, Obama’s chair of the NEC and noted center-left economist, “This is a "whatever it takes" moment for the Fed. They don't need to raise faster in June. But they need to be crystal clear that they will raise rates to 4, 5, 6, etc. if needed”.